We support our clients through all phases of their growth journey with experienced and expert capabilities in growth strategy assessments, market analysis, mergers and acquisitions, valuation and financial analytics, and capital advisory.

Strategy

We work with our client in evaluating some of their most important business initiatives. We approach our work with the mindset of former senior managers who have also faced many of these thorny and complex issues. Our strategy work has included:

Growth strategy planning:

We help our clients analyze and assess an international market before a market entry, including market sizing, competitive dynamics, growth analyses, and pricing / profitability assessments. Our work, often in partnership with our colleagues at the Albright Stonebridge Group, may also include understanding the policy and regulatory landscape and broader stakeholder engagement strategies.

Market exit and restructuring:

We assist clients as they are reevaluating or reorganizing their product portfolios in international markets and provide options for successful market exit.

Business Development execution

We offer hands-on support to our clients as they implement their growth strategies, including helping implement marketing plans, product roll-out and profile-raising in the eyes of strategic partners and investors.

Transactions

Strategic transactions, especially in complex and rapidly growing international markets, are often the most important and difficult decisions CEOs face. Having advisors who are experienced in cross-border transactions, who have local or regional presence, and who have excellent execution skills is critical. We help our clients manage and understand the benefits and pitfalls of international markets.

Mergers and Acquisitions:

We provide independent advice, without conflict, to assist senior management, boards of directors, and corporate development teams evaluate and execute mergers, acquisitions and divestitures around the world. Unlike many, our assessments and advice goes beyond the strictly financial analysis, to include a deeper understanding of the business, including industry structure, competitors and policymakers.

Partnerships and Strategic Alliances:

Forming and sustaining strong international partnerships and strategic alliances is a critical skill, and very different from traditional mergers and acquisition work. We help our clients identify and evaluate the best strategic partners for international expansion and help structure and negotiate alliances that work. Critical in this process is understanding reputational and brand risks, conducting due diligence on potential partners and projects, and aligning strategies and expectations.

International Licensing and Distribution:

The international licensing of intellectual property, especially in the healthcare and pharmaceutical sectors, requires a depth of local market knowledge and regulatory insights. We help our clients license new pharmaceutical products, technologies, and platforms across the world. We assist in valuation, financial planning, license structuring, negotiating terms, and post-transaction monitoring.

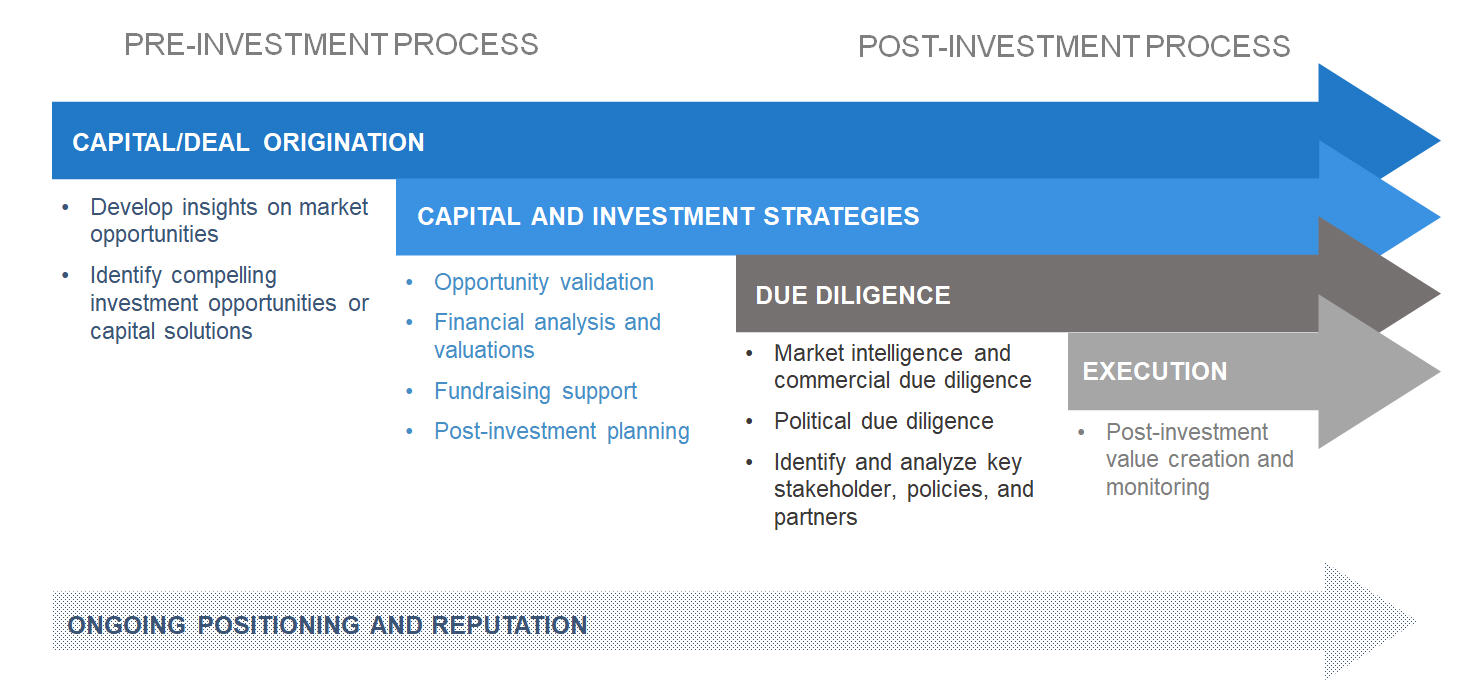

Capital

Capital Structure Advisory:

We provide senior management of our clients with objective advice on how to manage their corporate capital structure to meet their long-term objectives. This includes a detailed understanding of the business plan combined with an understanding of the risks – some unforeseen and disruptive – that must be taken into account. With decades of experience in advising clients on finding the right capital structure, we understand that the capital structure should reflect strategy and corporate culture as much as financial optimization.

Private Capital Raising:

For selected private clients, we raise capital to fund their long-term growth plans. We have executed equity, private debt and loan capital raises for clients across the globe, including from sovereign wealth funds, pensions, large private equity firms, development finance agencies, corporate banks, and family offices.

We offer comprehensive emerging market healthcare coverage focused on SME financing and investment opportunities